Hi everyone. I have a question about model calibration. I am a newbie and I apologize for asking this question. I have read Professor jpfeifer’s paper (A Guide to Specifying Observation Equations for the

Estimation of DSGE Models) But I don’t know exactly whether I am doing it right or not. Please clear me from this doubt.

I want to take help from the data and extract the parameters from the steady state of the model (Reverse the usual method)

. I divide all endogenous variables (except the rates) in the steady state by the output: (C_ss/Y_ss , I_ss/Y_ss , K_ss/ Y_ss , …)

I am dealing with two types of variables: stock variables (such as capital, deposit, loan …) and flow variables (such as output, consumption, …)

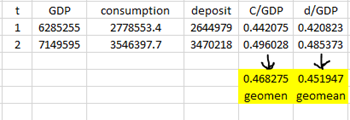

If I use annual data I can figure out how to calibrate. For example, if I have only two periods in the model And the data is as follows:

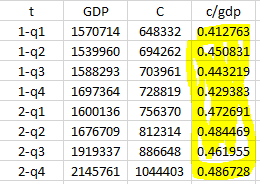

If the variables are flow type and the data is quarterly, there is no problem. For example, by having quarterly GDP and consumption data, we can compute the to consumption to production ratio: The geometric mean of the yellow column is equal to : C_ss/Y_ss= 0.4960

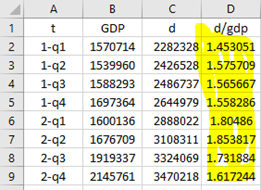

The problem arises when one of the variables is stock (for example deposit (d)) and one of the variables is flow (GDP) Also, the data is quarterly:

Do I have to divide the deposit variable of each quarter by the GDP variable in the same quarter?:

C2/B2 = 1.453051

C3/B3 =1.575709

C4/B4 =1.565667

…

And take the geometric mean from the results obtained in the D column (=1.64)

Accordingly, I calibrate based on whether my data is quarterly or annual like this:

Quarterly: d/GDP= 1.64

Annualy: d/GDP = 0.45

is it correct?