fkury

November 29, 2022, 12:06am

1

I am seeking Business Cycles Facts (US Based) so that I can compare with the business cycles facts generated from a simple RBC model with an externality described in the Dynare script below:

rbc_comp_e_withtaxVF_NEW.mod (5.6 KB)

I would really appreciate any suggestions that point to where I can find the data comparable with model results.

You have to elaborate on your question. What exactly are you trying to do? The usual approach is to compare the first and second moments of e.g. output, consumption, and investment per capita.

fkury

November 29, 2022, 4:09pm

3

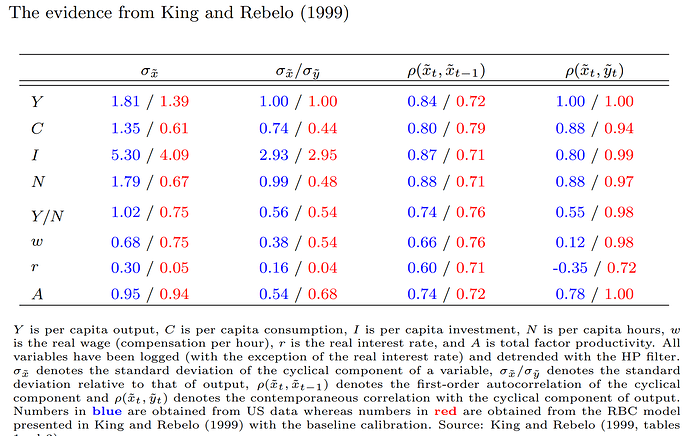

I would like to build a similar table as the follow:

Not sure whether I can the 1st and 2nd moments directly from the results the Dynare code below to compare:rbc_comp_e_withtaxVF_NEW.mod (5.6 KB)

Can use the same US numbers (in blue) to compare with the results I have from the model RBC with Tax?

fkury

November 29, 2022, 4:11pm

4

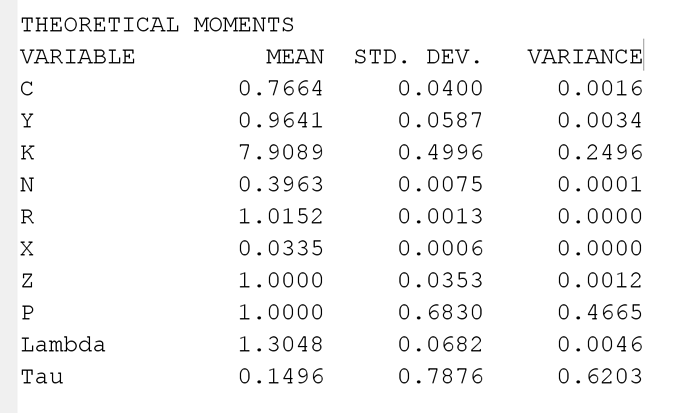

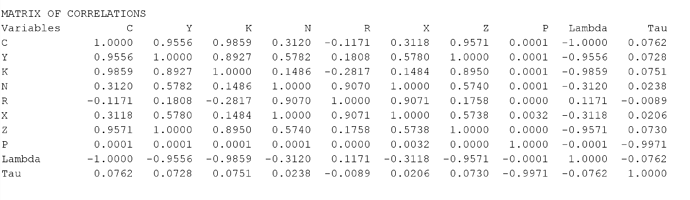

It seems that the model I have is generating 1st and 2sd moments numbers too far off from the US baseline.

fkury

November 29, 2022, 4:31pm

6

Please, find below some of the results I obtained:

I recommend that you follow closely the equations in King and Rebelo (1999) in order to replicate their first and second moments, and then the IRFs. As pointed out by @jpfeifer , pay special attention to describe variables in log-version. In @jpfeifer ’s Github, you can find an inspirational version that you could check it out. This also may be useful: RBC Baseline Model: steady-state derivations and implementation in Dynare (with preprocessing tips) - YouTube

1 Like

fkury

December 13, 2022, 10:35pm

8

Thank you Bruno and Prof. Pfeifer !! I have been away for a week on a business trip, but I am back to finish this project.

Kind Regards,