Dear Professor Pfeifer,

I have one question because I am struggling a lot currently. I did take a look at the paper that was provided by you.

Before I start, again to explain my situation, I am given functional form for U where U(C^{s}) is 1-e^{-qC^{s}} but I am not given functional form for \Omega.

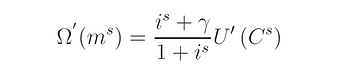

Okay, Page 37 of Woodford (1998) has following equation:

which seem to turn into following equation.

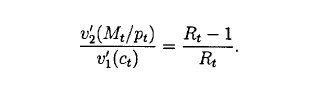

Now if I go back to Eggertsson et al. (2019),

I have following equation:

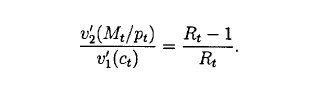

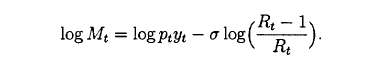

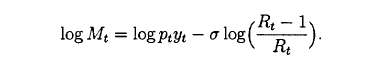

Following Woodford (1998), I converted the Eggertsson et al (2019)'s relationship between marginal utility for real money balance and marginal utility for consumption into:

C_{t}^{b} = (\frac{i^{b} + \gamma}{1+i^{b}})^{2.75} m^{b}_{t}

where \gamma is a money storage cost, m_{t}^{b} is real money balance of a borrower, C_{t}^{b} is consumption of borrower, i^{b}_{t} is lending rate, 2.75 is IES value.

I solved for steady state values for C_{t} and m^{b}_{t} but the differences in values seem to be very minor compared to values derived when ignoring money completely. That is, differences between derived steady state values for C^{b}_{t} and m^{b}_{t} (In this case, m^{b}_{t} would be 0) using Equation (56)-(58), Equation (61)-(70) and for Equation (58) using

C_{t}^{b}+\frac{1+i_{t-1}^{b}}{\Pi _{t}}b_{t-1}^{b}=\chi

Y_{t}+b_{t}^{b}

and derived steady state values for C^{b}_{t} and m^{b}_{t} using Equation (56)-(58), Equation (61)-(70) along with

C_{t}^{b} = (\frac{i^{b} + \gamma}{1+i^{b}})^{2.75} m^{b}_{t}

C_{t}^{s} = (\frac{i^{s} + \gamma}{1+i^{s}})^{2.75} m^{s}_{t}

are very minor.

My question is, Did I correctly followed the procedure to derive the steady state values of variables in Cashless limit economy? If not, Could you please elaborate what it means to be taking the limit? For which nonlinear equation in Eggertsson et al. (2019) do I have take the limit? An example would be great…if possible. If not, I understand.

Sorry for the long question, Professor.

Have a great day,

Sincerely,

Eric