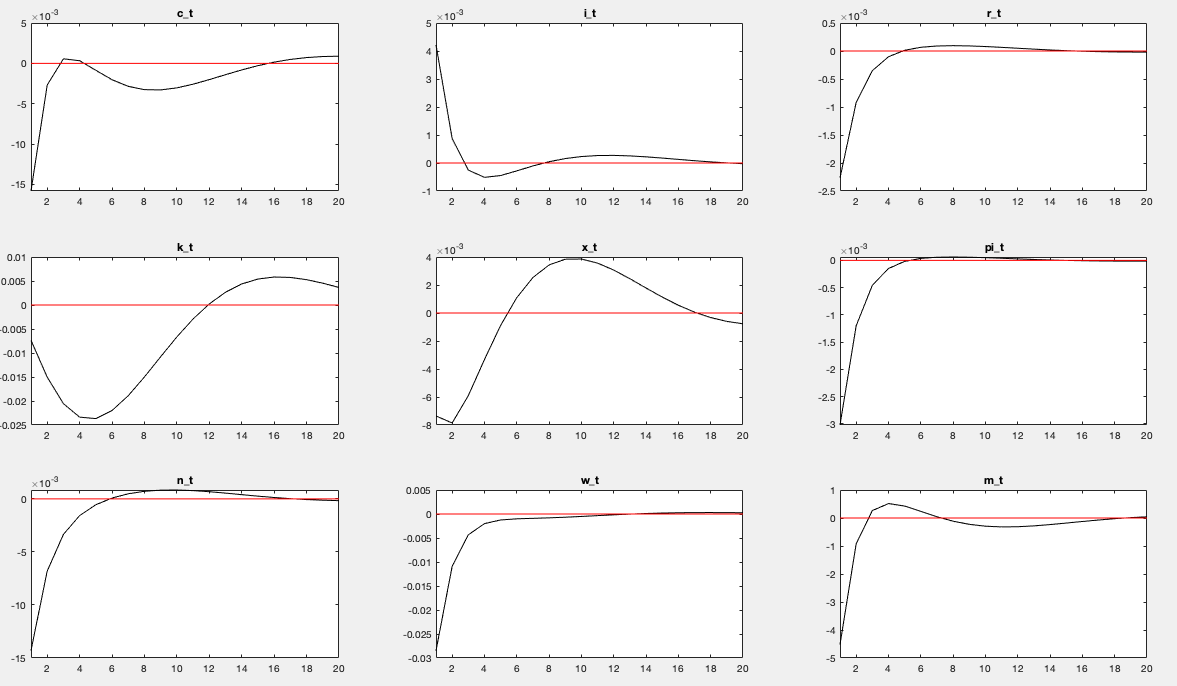

I’m working with NK-Calvo model incorporating capital adjustment costs and investment adjustment costs (not simultaneously), the latter adj. costs as explained in Sims’ class notes (section 2.3). Particularly for example, when I use the CEE (2005) investment adjustment costs, these are the responses from a Taylor rule shock:

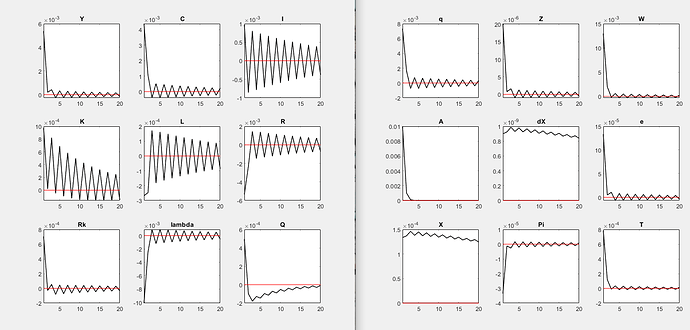

Which seem kind of odd to me. I’ve read some of the posts in this forum that treat the “oscillating” behavior of IRFs and its relationship (sometimes) with wrong timing. In that sense, there arise two questions. First, if the irfs were to be wrong, it’s almost certain (I think) that the timing misspecification comes from investment/capital’s dynamic motions set-up. Focusing only in the case of CEE, they specify the capital law of motion as (see eq. 3.21):

k_{t+1}=(1-\delta)k_{t}+\frac{\phi}{2}\left(\frac{I_t}{I_{t-1}}-1 \right)^2+I_t

Now, what I did in order to be congruent with Dynare’s timing convention, is rearranging this equation to:

k_{t}=(1-\delta)k_{t-1}+\frac{\phi}{2}\left(\frac{I_t}{I_{t-1}} -1 \right)^2+I_t

And then proceeded to find first order equilibrium conditions using the latter. Is this procedure right or did I miss something important?

Similarly, capital adjustment costs would convert from:

k_{t+1}=I_t+(1-\delta)k_t-\frac{\phi}{2}\left(\frac{I_t}{k_{t}}-\delta\right)^2k_t

to

k_{t}=I_t+(1-\delta)k_{t-1}-\frac{\phi}{2}\left(\frac{I_t}{k_{t-1}}-\delta\right)^2k_{t-1}

Is this also right? (the irfs reported by me come from the timing that I think is correct, the second ones)

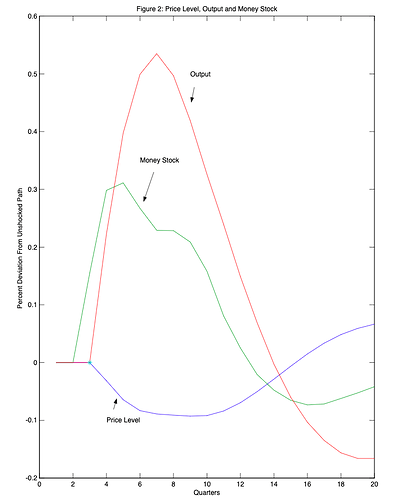

Now in the other hand, checking some of the figures reported in the mentioned CEE paper I noticed that indeed they obtain oscillating irfs from theoretical model, maybe suggesting that the irfs I get are not wrong (I’m not comparing signs or the exact irfs due to we’re using at least different calibrations, I’m only checking the fact that those are also oscillating), see e.g.

To summarize, I’d be grateful if you may give me some comment in determining if my irfs are right in light of the described procedure that I followed with cap/inv laws of motion, particularly if you may confirm that the mentioned procedure is correct but irfs are not correct, then I’ll check my math and code. However, if it turns out to be that all that is correct, and therefore this oscillating irfs are ok, I’d be grateful if you could explain me the economic nature of such behavior (if in a first instance you could answe.

Thanks!

PD: Note that this behavior not only occurs in TR shocks but also in other types of shocks.

nkm_cap_inv_adj_cost_steadystate.m (1.8 KB)

nkm_cap_inv_adj_cost.mod (5.1 KB)