Hi, I have a simple new Keynesian model with energy.

household: household decide on consumption, leisure, and money holding. their consumption is a combination of energy and final goods.

Firms: There are two types of firms in this model. Firms that produce intermediate goods are produced using capital, labor, and energy. firms that produce final goods aggregate these intermediate goods and sell them to households. firms that produce intermediate goods have a price rigidity using the Calvo method.

**government:**In this model, the government owns the energy and sells it to households and firms. When the price of energy increases, the government gives the same amount of subsidy to the household.

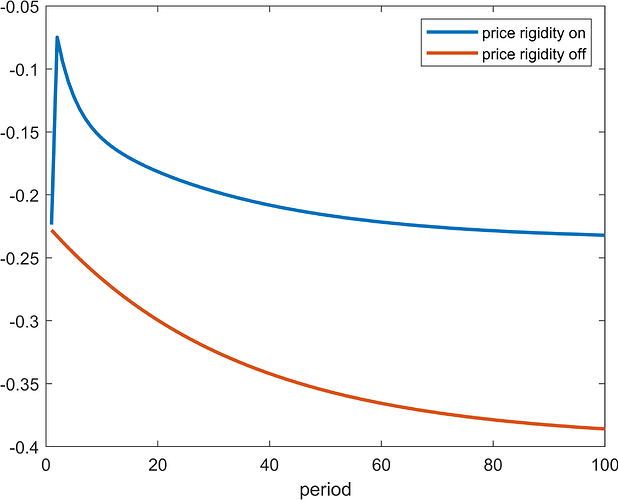

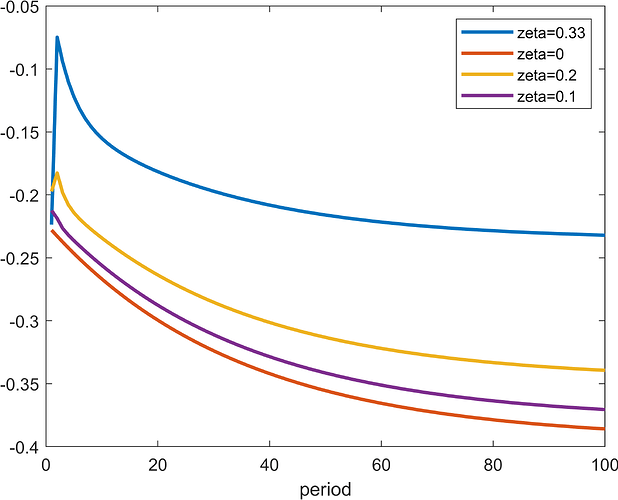

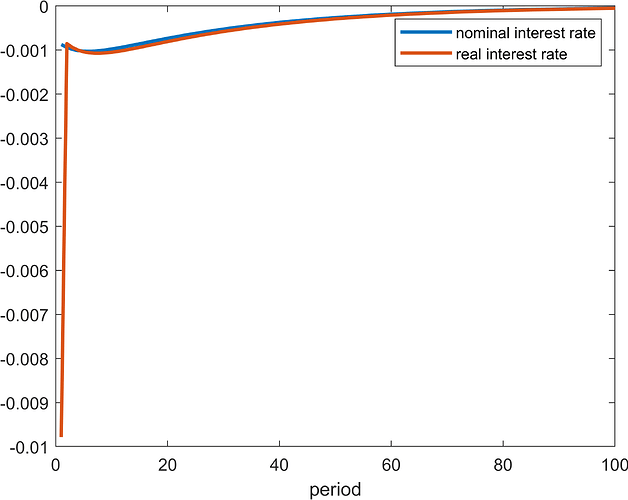

Now when I simulate a model with a permanent increase in energy price, production has strange behavior.

It’s logical that production must be decreasing.but when I turn on price rigidity, production jumps in period 1. And I do not understand the meaning of this jump.Can anyone help me?

I attach the production with price rigidity and without.

very thanks.