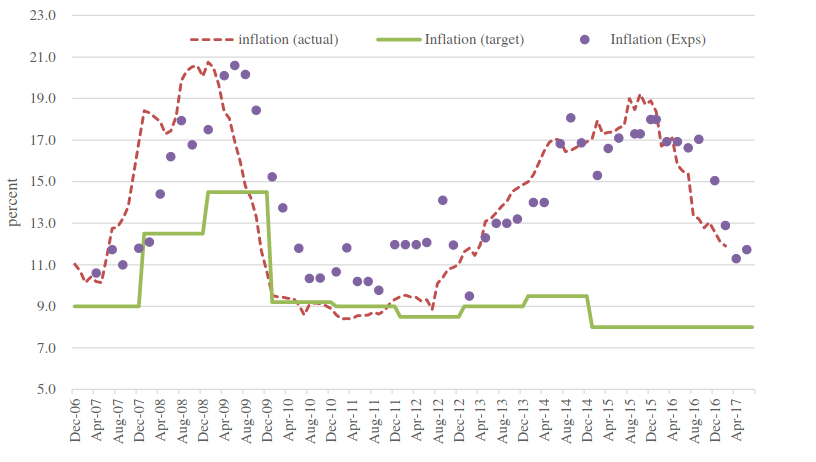

Is a weak anchoring of inflation expectations generally consistent with a low-price stickiness story? In my country, inflation expectations are not well anchored as shown below…large deviations from the target. Using this data, I estimate a low Calvo parameter of like 0.268. I think that result is consistent with the story in this picture. Or not really?

I am not sure it’s about the inflation expectations. With high Calvo price stickiness, actual inflation is constrained to move too much. If firms cannot change prices at all, inflation must trivially be zero. The volatile actual inflation will naturally constrain the estimated stickiness.