Hi guys, I have a question about the relationship of the three-country model. The question may be a little complicated but I really really need help, so thank you for your patience. Here it is.

There are three countries: H M and A.

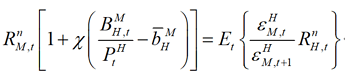

For H, it has two UIPCs, which are

(1) and

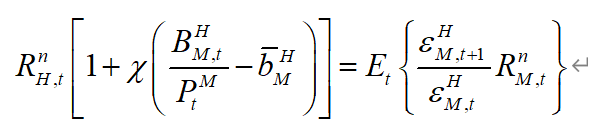

(1) and

(2)

(2)

H uses PEG poicy to A, wihch is ![]() =0.

=0.

(Rn_H, Rn_M and Rn_A are the nominal interest rate of H, M and A. ε_HM is the nominal exchage rate of H and A, which is the price of currency M measured by currency H. ε_HA is similar. ![]() is portfolio adjustment costs and B_HM is the bond of M bought by H, B_HA is the bond of A bought by H.)

is portfolio adjustment costs and B_HM is the bond of M bought by H, B_HA is the bond of A bought by H.)

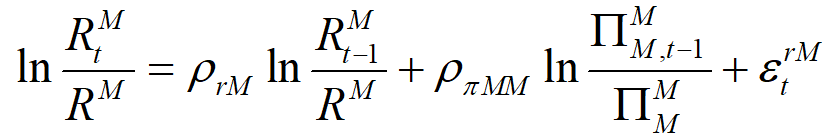

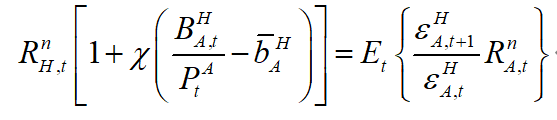

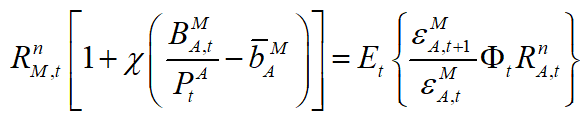

For M, it also has two UIPCs, which are

M uses Talor rules policy, which is

(note that:

So, here is my question. If there is a positive capital outflow shock, when means

For me, It looks like that, as the currency of M become cheaper, the capital of H still flows into M more than before. Does this match reality? (Besides, I found the M buys more bonds of A, while A buys more bonds of H, and at last, H buys more bonds of M, they have formed a circulation!)

Thanks again for reading my question and answering.