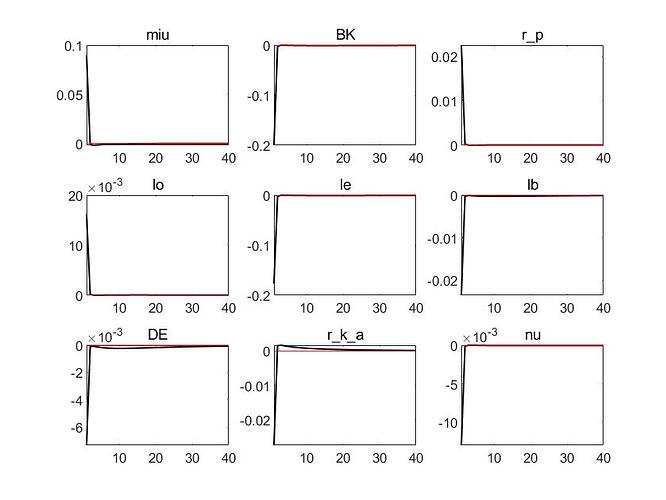

dear all.I think the time for endogenous variables to return to steady state under the impact of monetary policy in my model is shorter. There is no way to solve this problem. I’m using the basic Taylor rule.i=kappa_ri(-1)+(1-kappa_r)(kappa_yy+kappa_pipi)+epsilon_r.kappa_r=0.5;kappa_y=0.0535;

kappa_pi=2.0868;var epsilon_r; stderr 0.0178.

This looks like a case of

.I’m sorry, but I still don’t understand. Mine is quarterly data, and I feel that the endogenous variables return to steady state too quickly under the impact of monetary policy. I adjusted the Taylor rule reaction coefficient a lot, but I still found these problems。

Do these variables themselves quickly return to steady state in the event of an interest rate shock?

As I have written above, your shock itself has no persistence and your model does not feature endogenous persistence mechanisms. For that reason, the quick return to steady state is expected.

Dear jpfeifer,thank you very much for your answer. I put the shock in the back of Taylor’s rule equation. Now I change the shock behind Taylor’s rule to an AR(1) a process. I found it better. Is there some way to sum up the monetary policy equation setting?

What do you mean?

I mean is there a summary of how to set monetary policy rules? Such as the literature summarizing the setting of monetary policy rules.

I mean is there a summary of how to set monetary policy rules? Such as the literature summarizing the setting of monetary policy rules.I found that several of my models had poor monetary-policy shock persistence.

Taylor rules depend on the country and sample studied. There is no general rule. The issue in your model is more likely that it is too stylized and does not have endogenous state variables that yield endogenous propagation. You cannot expect a toy model to give realistic results.