Hi , Thank you for the reply and sorry for the late reply.

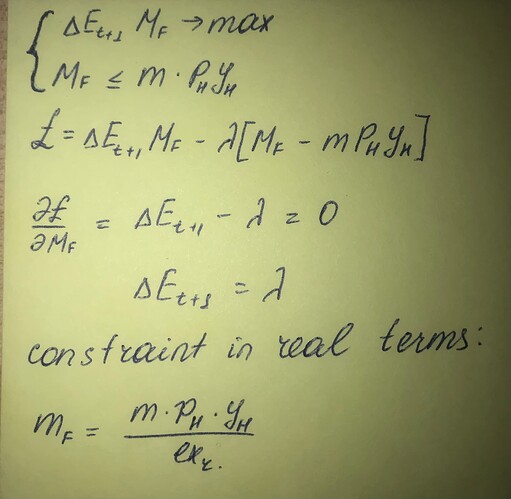

I try to solve the following optimization problem.

I consider a currency exchange company which maximizes its profit, which he gets from buying and selling dollar (m_f)

My constraint in real terms is

m_f <= m* p_h * y_h / ex_r, which indicates that people can buy dollars up till some share of nominal GDP.I got the following FOC

delta(e(+1)) = lambda. This means when the constraint is binding, exchange rate is increasing (lambda is a non-negative number) , or , in other words, domestic currency is depreciating .How can I apply this occasionally binding constraint in my code?

Thank you in advance