Hi Prof. Pfeifer

Why in models with fiscal policy tax rates are modeled as a AR(1) process? They are constant in the short term.

I really appreciate any help you can provide.

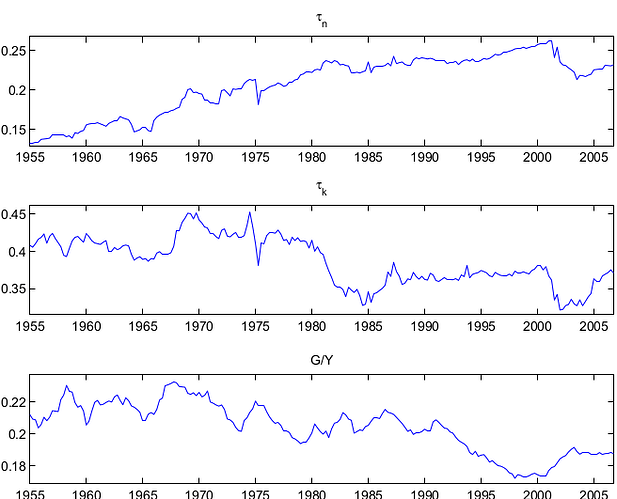

In Born/Peter/Pfeifer (2013) we computed effective tax rates following Mendoza et al (1994). As you can see, the tax rates fluctuate quite a bit at the quarterly level:

What you have in mind are statutory tax rates, but these may not be economically relevant.

Dear jpfeifer,

Could you give some references aditionals to understand why statutory tax rates may not be economically relevant?

I would apreciatte a lot it if you kindly guide me to understand it.

Please.

Thanks a lot.

Economically, what matters are effective marginal tax rates. They are the ones that govern your economic decisions. Due to various loopholes, deductions etc. statutory tax rates are not the tax rates that are actually paid. See e.g. https://www.cbpp.org/research/federal-tax/actual-us-corporate-tax-rates-are-in-line-with-comparable-countries

Thanks a lot dear jpfeifer.