Dear prof. Pfeifer and community,

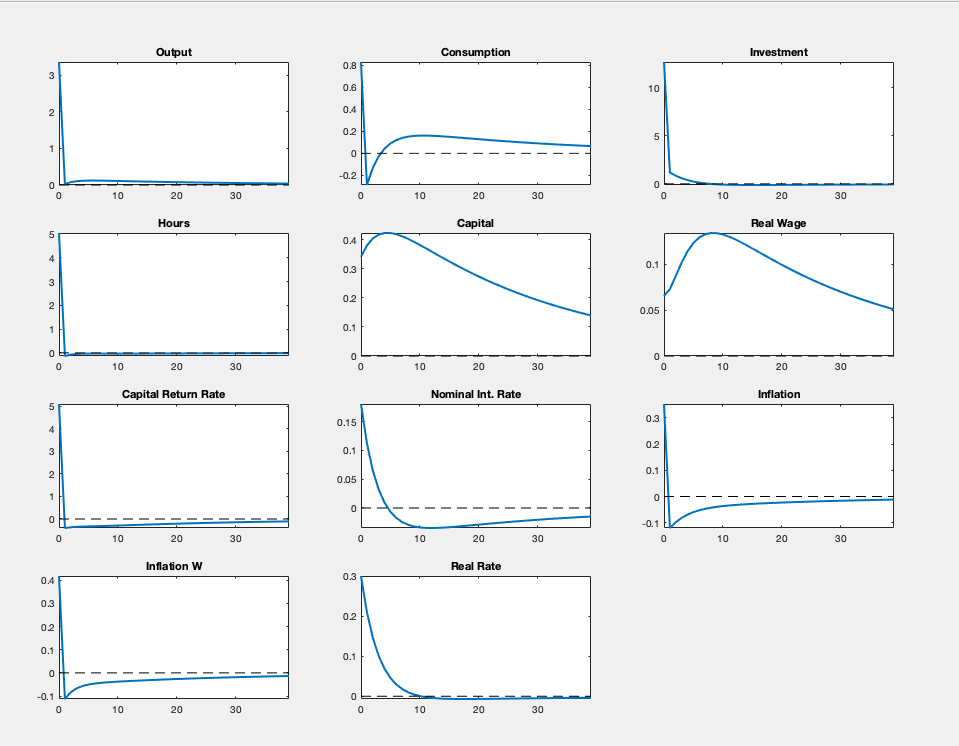

In a DSGE Model with non-separable utility function, sticky wages and sticky prices I simulate an Investment shock. In a standard RBC model the wages are supposed to go sharply down and then recover, how can I explain the difference with the current model based on the Impulse Response function and equations? I will provide the plot and the .mod file

esercizio1.mod (4.8 KB)

Thank you

Capital increases massively, increasing the marginal product of labor.

Thank you for your prompt reply, I see there is a delay on Capital.

I am left with one doubt: can you please elaborate on how the propagation works, in particular how the marginal product of labor increases?

In constant returns to scale production functions, the inputs are q-complements. Thus, an increase in capital per worker will increase the marginal product of labor. With Cobb-Douglas and competitive markets:

W=\alpha\left(\frac{K}{N}\right)^{1-\alpha}

1 Like