Dear all,

I build a DSGE model. When output data are used, the response coefficient of output in Taylor’s Rules is very large, greater than 1. When inflation data are used, the response coefficient of output in Taylor’s Rules is normal. I want to ask why it happens?Is it possible that there is a problem with data processing?

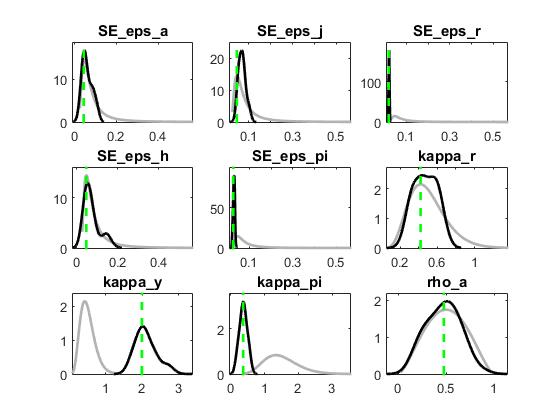

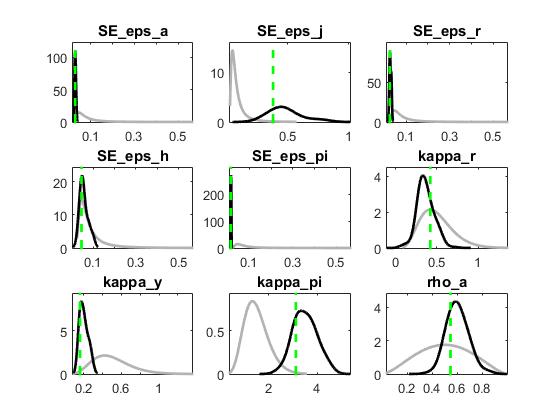

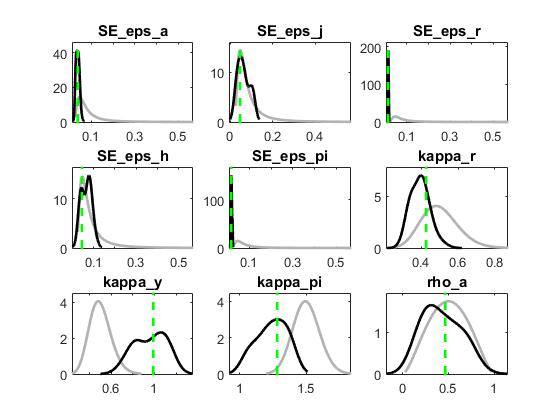

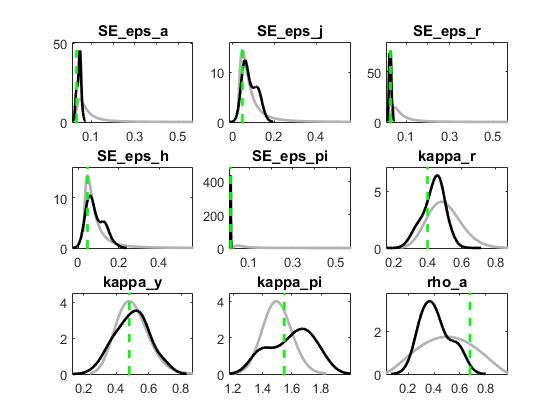

When some data are used, the response coefficient of the output gap is even greater than 2.When some data combinations are used, the response coefficient of output gap is about 0.5.It’s normal.I really don’t know why it happened. Is there something wrong with my data processing?But some data combinations can produce more positive results. I’m really confused. Hope to get an answer.

Thank you in advance.

data.xls (33 KB)

data.xls (33 KB)

house1224.mod (9.7 KB)

That is impossible to tell. Depending on what you match, results can differ. If you get varying sizes you should check whether all observables have the right frequency, i.e. are annual or quarterly. If inflation is measured at a different frequency, that can explain the differences. Apart from that:

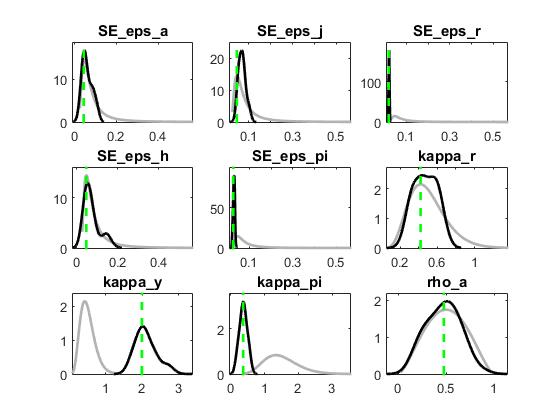

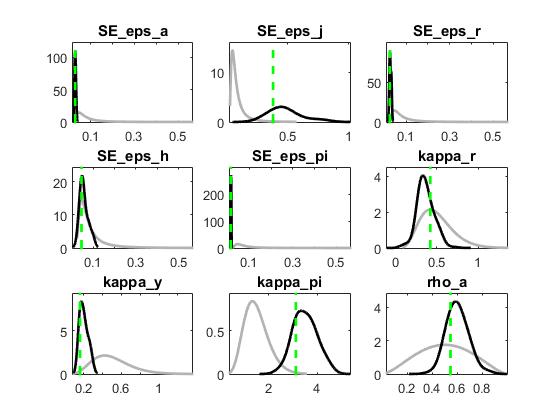

- Some parameters look not identified, e.g.

rho_a

- Your MCMC has clearly not converged yet.

jpfeifer,thank you for your reply.

All the data I use are quarterly data. There should be no frequency problem.

I’m a little confused about your answer.

1.“Some parameters look not identified, e.g. rho_a”,why rho_a is not identified? There is rho_a estimates in the estimates.

2.“MCMC has clearly not converged yet.” I’m sorry I don’t know how to judge MCMC’s convergence. To make the program run faster, I set the MCMCMC to a smaller value.“MCMC has clearly not converged yet.” Is this reason? But it does not affect the final result.

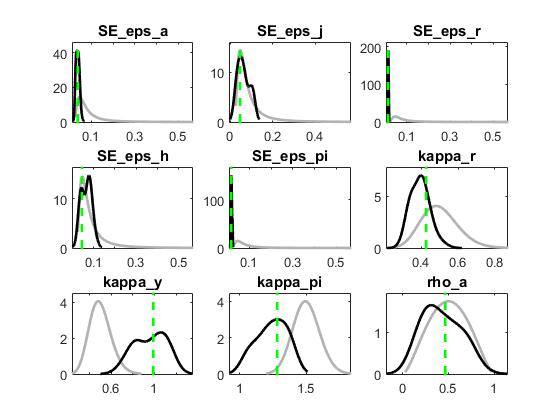

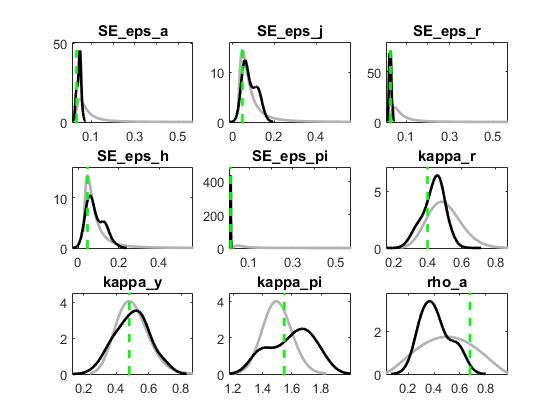

When I get the coefficient of the output gap of 1,the coefficient of inflation is usually small.

When I get normal coefficient of the output gap,the coefficient of inflation is usually too large.

Like the following figure. Is this a common problem?

data.xls (33 KB)

data.xls (33 KB)