Thanks for your answer, professor Pfeifer.

I think I did not express myself correctly. What I want to know it is why in Gali’s book setup (in open economy), the risk-sharing condition occurs not only in average. I think that setup feature a full set of securities.

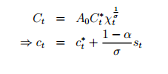

The risk-sharing in Gali’s is:

c_t=c_t^* + \frac{1}{\sigma} q_t (Eq 1)

The budget constraint is:

P_t C_t +E_t\{Q_{t,t+1} D_{t+1}\} \leq D_t +W_t N_t +T_t

He says that Q_{t,t+1} is the stochastic discount factor and

Q_{t,t+1} \equiv \frac{V_{t,t+1}}{\xi_{t,t+1}}

where V_{t,t+1} is the period t price of and Arrow security if a specific state of nature is realized in t+1

Henceforth is my interpretation of Gali’s. I would like to know if I understood everything correctly.

If the previous equation if verified for every state of nature i, there is a full set of arrow securities.

Hence D_{t+1} may be interpreted a vector of the quantities of each arrow security is bought in t. Each row of this vector is D_{t+1}^i.

I am assuming finite states (I do not know how it would be with infinite states).

In this case, one can write:

Q_{t,t+1} \equiv \frac{V_{t,t+1}^{j,i}}{\xi_{t,t+1}^{j,i}}

where:

\xi_{t,t+1}^{j,i} is the probability to pass from state j in t to state i in t+1

V_{t,t+1}^{j,i} is the price of a arrow security that pays one unit of domestic currency if state i is realized in t+1 given that the state in t is j.

The bugdget constraint could be rewritten in:

P_t C_t + \sum_{i \in I} V_{t,t+1}^{j,i} D_{t+1}^i \leq D_t^k + W_t N_t +T_t

where D_t^k is the quantity bought for state k (the state realized in t).

If I am right until here, it means that the Lagrangian is:

L=\sum \beta^t E_0 \bigg\{ U(C_t,N_t) +\lambda_t \big[ D_t^k + W_t N_t +T_t -P_t C_t - \sum_{i \in I} V_{t,t+1}^{j,i} D_{t+1}^i \big] \bigg\}

where I comprises all the possible states.

Then the FOC wrt D_{t+1}^i is (not so sure about the first equation):

\lambda_t V_{t,t+1}^{j,i}=\beta E_t \{ \lambda_{t+1} \} \Rightarrow \lambda_t V_{t,t+1}^{j,i}=\beta \lambda_{t+1} \xi_{t,t+1}^{j,i} \Rightarrow \frac{\lambda_{t+1}}{\lambda_t} = \frac{1}{\beta}\frac{V_{t,t+1}^{j,i}}{\xi_{t,t+1}^{j,i}} (Eq 2)

If it is right that (Eq 2) holds for every states (j,i) , then

\frac{\lambda_{t+1}}{\lambda_t} = \frac{1}{\beta}Q_{t,t+1}

And then I can see that risk-sharing condition happens not only in average as in (Eq 1)

Is there any problem with my understanding?

Thank you again.